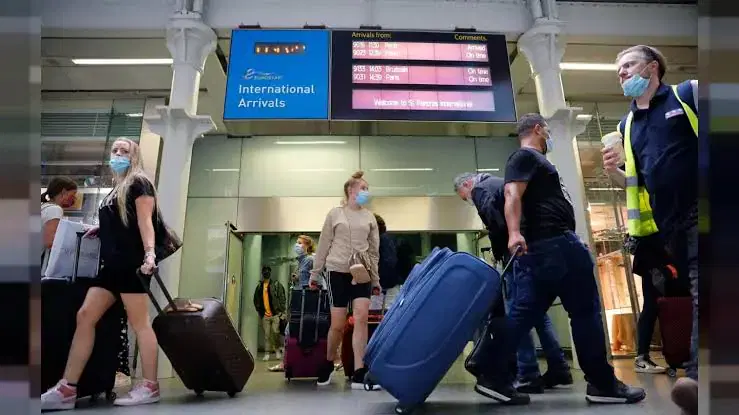

Weekly diaspora remittances have reached $30m- Emefiele

The Central Bank Governor, Godwin Emefiele has said that weekly diaspora remittances rose from $5m to $30m.

He noted that the initiatives introduced by the Central Bank of Nigeria to boost forex in the country were yielding result.

Emefiele spoke during the CBN/Bankers Committee’s initiative for economic growth which was organized with Vanguard on Friday.

Stakeholders from the financial sector were in attendance, while state governors and other dignitaries attended virtually.

The theme of the event was “ How to overcome the pitfalls of recession; Bankers perspectives on an enduring national growth path “.

On remittances, he said, “The CBN has already taken several measures to increase the flow of diaspora remittances into the country using formal channel.

“In December 2020, we instructed all international money transfer operators to provide remitters with the option of sending foreign exchange to beneficiaries in Nigeria.

”This new measure has helped to reduce the diversion of forex by some IMTOs, who had thrived from forex arbitrage arrangements, rather than on improving transactions volumes to Nigeria.

Recently, the CBN vowed to withdraw the operating license of operators who continued to violate the rules regulating diaspora remittances into the country.

It stated that it will to tolerate the clear contravention of its directives that all remittances be paid to beneficiaries in dollars.

The CBN stated this in its circular to all authorized dealers and International Money Transfer Operators titled, “Modalities for payout of diaspora remittances”, which was signed by the Director, Trade & Exchange Department, Dr. O.S Nnaji.

”Strict sanctions including withdrawal of licenses, shall be imposed on any individual and/or institutions found to be aiding, abetting or directly contravening these guidelines.

For unlicensed operators, it added, “The CBN shall no hesitate to authorize the closure of their accounts in Nigerian banks, including being banned from accessing banking services in Nigeria”.

The CBN said, for the avoidance of doubt, only licensed IMTOs were permitted to carry on the business of facilitating diaspora remittances into Nigeria.