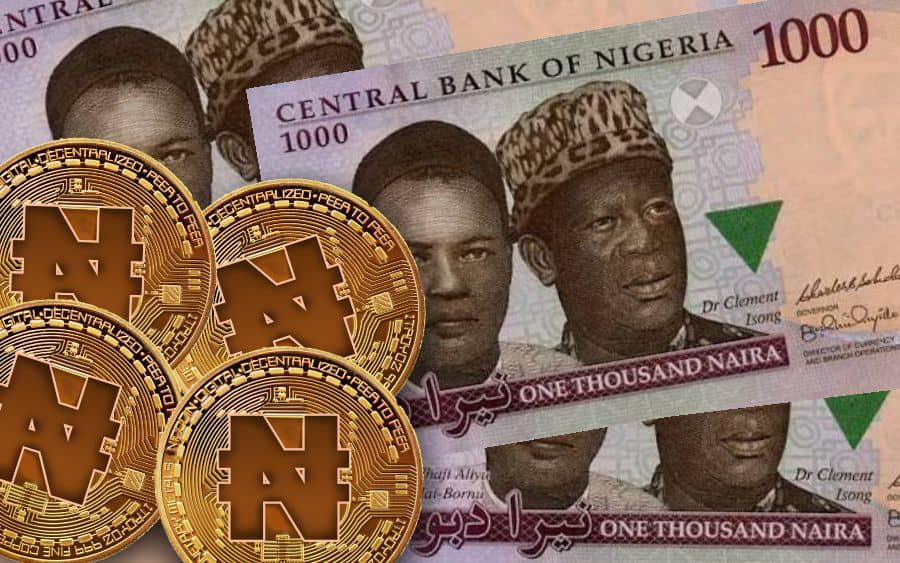

CBN’s digital currency will begin before 2022- Bankers’ Committee

The Director, Information technology Department, central Bank of Nigeria, Mrs. Rakiyat Muhammed, has said that the banking regulator will launch a digital currency before the end of 2021.

Muhammed disclosed this during a briefing on the Bankers’ Committee meeting on Thursday.

She said, about 80% of central banks in the world were exploring the possibility of issuing central bank digital currency and Nigeria could not be left behind.

For over two years now, she added, the CBN had been exploring technology and had made tremendous progress.

Explaining what the Central Bank digital currency would be, she said there were currently two forms of money in the country.

She added, “We have in two forms in Nigeria as of now, there are the notes and there are the coins.

“So, the Central Bank currency is to be the third form of money, which means, just as we have electronic money, digital money is not new in Nigeria”.

“Just as we are about the third or fifth in the whole world as far as advancement in the use of digital money is concerned.

“So, this is going to complement the coins and cash that we have.

“The Central Bank digital currency will just be as good as you, having cash in your pocket and even as you have the cash in your pocket, you are going to have the cash on your phone”.

She said the Central Bank was looking at different use cases such as remittances.

The Director said, “We all know how money has to travel for someone to send money from Nigeria to abroad and it is a huge money in Africa.

“We also know that recent report by EfiNA was that our target was to achieve 80 per cent financial inclusion. We are about 60 per cent and at the rate which we are going, we are not going to meet this target.

“Central Bank digital currency will accelerate our ability to meet this target”.