Ghana Begins Visa On Arrival For Nigerians, Others Amid Liquidity Problem

In a bid to boost its revenue from the tourism industry and investments during the festive period in December and the new year, the Ghanaian government has commenced visa on arrival.

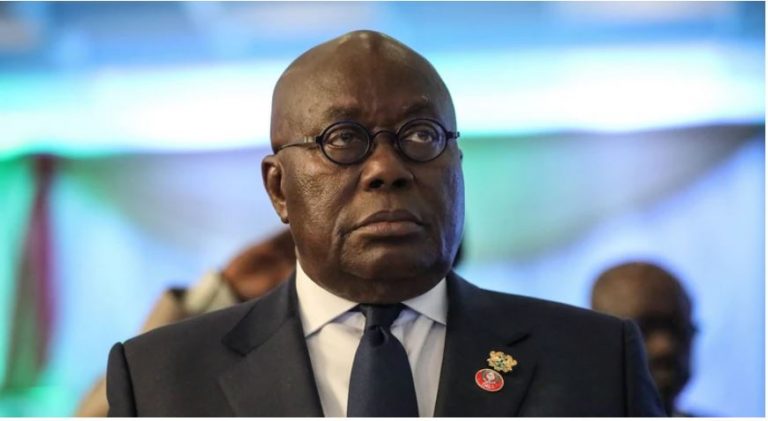

The Ghanaian government is currently expressing liquidity problem that has forced Ghana’s president, the Nana Akufo-Addo, to suspend repayment of debt service under certain categories of its external debt such as eurobonds, commercial terms and other investment securities.

According to the country’s transport minister, Kwaku Ofori Asiamah, the policy was initiated to improve economic relations and investments from the diaspora and citizens of other African countries like Nigeria.

In the statement conveying the new policy, it was disclosed that the visa on arrival becomes effective from December 22, 2022, to January 15, 2023.

It added that, “Following consultation between the ministry of foreign affairs, the ministry of interior, the ministry of tourism, art and culture, Ghana immigration service and the Ghana tourism authority, approval has been given for passengers travelling to Ghana to opt for visa-on-arrival waiving the requirement for prior approval.”

The statement also reads, “Consequently, it will be appreciated if systems are updated to reflect the new arrangement and all those responsible for checking-in passengers travelling to Ghana advised not to insist on entry visas prior to their boarding.”

Meanwhile, amid Ghana‘s plan to economically benefit from the visa on arrival policy, some foreign investors are unable to recover their investment in eurobonds, commercial terms and most of the nation’s bilateral debt.

Akufo-Addo had stated four days ago that, “As it stands, our financial resources, including the Bank of Ghana’s international reserves, are limited and need to be preserved at this critical juncture.

“That is why we are announcing today a suspension of all debt service payments under certain categories of our external debt, pending an orderly restructuring of the affected obligations.”