Mastercard Study Finds 83% of Nigerian Women Embracing Entrepreneurship

A new Mastercard study has shown that Nigerian women are embracing entrepreneurship at an impressive rate, with 83% considering themselves entrepreneurs. This figure is far higher than the regional average of 51% across Eastern Europe, the Middle East, and Africa.

Millennial women are leading this wave, with 86% identifying as entrepreneurs, surpassing their male counterparts at 79%. The research, titled “Empowerment for All,” was released ahead of International Women’s Day 2025. It highlights key motivations driving Nigerian women into business, including financial independence, personal ambition, and the desire to turn innovative ideas into reality.

According to the study, 49% of Nigerian women started their businesses to fulfill a dream, while 45% aimed to bring a great idea to life. Additionally, 87% of women engage in side hustles alongside their main jobs, reflecting a strong entrepreneurial spirit.

Selin Bahadirli, Mastercard’s Executive Vice President for Eastern Europe, the Middle East, and Africa, stated, “Women entrepreneurs are thriving, with younger generations leading the way. By providing the right financial tools, mentorship, and digital resources, we can help them unlock new opportunities and contribute significantly to economic growth. Mastercard remains committed to supporting women-led businesses.”

The study also found that 90% of Nigerian women aspire to start their own businesses, with major motivations being financial independence (67%), generating more income (83%), and creating financial security (52%). Looking ahead, 93% of business owners—both men and women—expect revenue growth over the next five years.

Women in Nigeria are entering diverse industries, with agriculture (36%) leading the way, followed by food and drink (22%) and education (20%). However, despite their strong drive, many women face confidence issues, with 15% saying they lack confidence to start a business—more than double the 7% of men who feel the same.

Access to funding remains a major challenge, with 57% of women struggling with a lack of financial support and 40% finding it difficult to secure startup capital. Other barriers include balancing childcare responsibilities, financial stability concerns, and limited access to digital tools. Notably, 35% of women say they lack access to essential digital infrastructure for business growth.

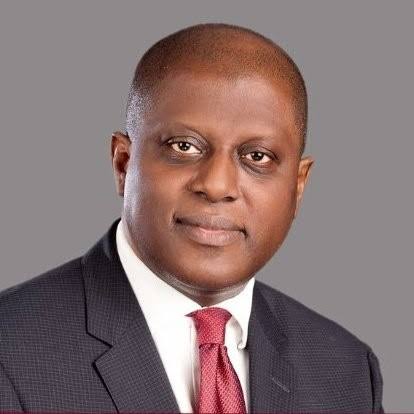

Folasade Femi-Lawal, Mastercard’s Country Manager for West Africa, emphasized the need for more financial support, business training, and access to funding schemes. “With 83% of women embracing entrepreneurship, we have a great opportunity to drive inclusive economic growth. Addressing key barriers will help ensure their full potential is realized,” she said.

Interestingly, Nigerian women are also at the forefront of AI adoption, with 80% using artificial intelligence in their businesses—almost double the rate of men (45%). AI adoption has led to significant cost and time savings for 82% of female entrepreneurs. However, women are also more vulnerable to cyber threats, with 51% reporting fraud attempts compared to 35% of men. Cybersecurity remains a major concern, as 65% of women worry about cyberattacks daily.

To support women entrepreneurs, Mastercard has partnered with organizations like SMEDAN, LSETF, KaiOS, and Allawee, providing access to financial resources, digital tools, and business training. These efforts aim to bridge the gaps in funding, digital access, and security, empowering Nigerian women to thrive in business.